#How to identify and trade the Harami Cross candlestick pattern

Explore tagged Tumblr posts

Text

How to Trade the Harami Cross (Bullish) Pattern: A Complete Guide

The Harami Cross (Bullish) pattern is a powerful and reliable candlestick formation in technical analysis that signals a potential reversal from a downtrend to an uptrend. Understanding how to identify and trade this pattern can give traders an edge in timing entry points and managing risk effectively. In this post, we’ll break down the Harami Cross (Bullish) pattern, explain its significance,…

#Best bullish reversal patterns#Best strategy for trading bullish Harami Cross in stock market#Bullish candlestick pattern strategy#Bullish Harami Cross strategy#Bullish Harami trading strategy#bullish momentum shift#Bullish reversal candlestick patterns#candlestick chart reversal signals#Candlestick patterns for beginners#Doji candlestick meaning#Harami Cross Bullish Pattern#Harami Cross candlestick pattern#Harami Cross chart example#Harami Cross confirmation signal#Harami Cross pattern entry and exit points#Harami Cross strategy for beginners in technical analysis#Harami Cross technical analysis#Harami Cross trading setup with confirmation#Harami Cross vs Bullish Harami#Harami Cross with volume confirmation strategy#How to identify and trade the Harami Cross candlestick pattern#How to identify Harami Cross#How to trade Harami Cross#How to use RSI with bullish Harami Cross#Japanese candlestick patterns#learn technical analysis#Price action trading strategy#Profitable candlestick patterns for swing traders#reliable candlestick signals#Step-by-step guide to bullish Harami Cross pattern

0 notes

Text

Trading the Bullish Harami Pattern

New Post has been published on https://forexsuccesstips.net/trading-the-bullish-harami-pattern/

Trading the Bullish Harami Pattern

Learn to Trade the Bullish Harami

The Bullish Harami consists of two candlesticks and hints at a bullish reversal in the market. The Bullish Harami candlestick should not be traded in isolation but instead, should be considered along with other factors to achieve Bullish Harami confirmation.

This article will cover:

What is a Bullish Harami Pattern

How to Identify a Bullish Harami on a trading chart

How to trade the Bullish Harami candlestick pattern

What is a Bullish Harami Pattern?

The Bullish Harami candle pattern is a reversal pattern appearing at the bottom of a downtrend. It consists of a bearish candle with a large body, followed by a bullish candle with a small body enclosed within the body of the prior candle. As a sign of changing momentum, the small bullish candle ‘gaps’ up to open near the mid-range of the previous candle.

The opposite of the Bullish Harami is the Bearish Harami and is found at the top of an uptrend.

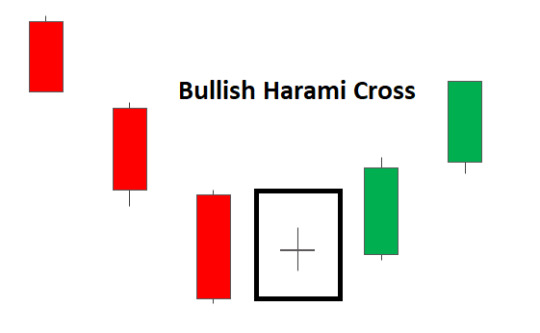

The Bullish Harami Cross

Traders will often look for the second candle in the pattern to be a Doji. The reason for this is that the Doji shows indecision in the market. The colour of the Doji candle (black, green, red) is not of too much importance because the Doji itself, appearing near the bottom of a downtrend, provides the bullish signal. The Bullish Harami Cross also provides an attractive risk to reward potential as the bullish move (once confirmed) is only just starting.

How to Identify a Bullish Harami on Trading Charts

The Bullish Harami will look different on a stock chart compared to the 24- hour forex market, but the same tactics apply to identify the pattern.

Bullish Harami Checklist:

Spot an existing downtrend

Look for signals that momentum is slowing/reversing (stochastic oscillators, bullish moving average crossover, or subsequent bullish candle formations).

Ensure that the body of the small green candle measures no more that 25% of the previous bearish candle. Stocks will gap up, showing the green candle mid-way up the previous candle. Forex charts will mostly show the two candles side by side.

Observe that the entire bullish candle is enclosed within the length of the previous bearish candle’s body.

Look for confluence with the use of supporting indicators or key levels of support.

Formation of the Bullish Harami Pattern in the Forex market

The forex market operates on a 24/5 basis which means when one candle closes, another opens at virtually the same level of the previous candle’s closing price. This is often observed under normal market conditions but can change during periods of high volatility. The Bullish Harami pattern in forex will often look something like this:

The small green candle opens at the same level that the prior bearish candle closed at. This is typically observed in the forex market.

Formation of the Bullish Harami Pattern on Stock Charts

Stocks on the other hand, have specified trading hours during the day and are known to gap at the open for many reasons. Some of those might be:

Company news released after the close of trade

Country/sector economic data

Rumoured takeover bids or mergers

General market sentiment

Therefore, the traditional Harami pattern appears, as seen below for Societe General (GLE FP) which trades on the CAC 40:

Notice how there are numerous areas on the chart where the market has gapped – showing wide open spaces between candles. This is often observed in the stock market.

How to trade the Bullish Harami Candlestick Pattern

Traders can adopt the Bullish Harami using the five-step checklist mentioned earlier in the article. Looking at the below chart on GBP/USD we can observe the following

There is a clear downtrend.

A Bullish Hammer appears before the Bullish Harami and provides the first clue that the market may be about to reverse.

The bullish candle is no more than 25% the length of the previous candle.

The bullish candle opens and closes within the length of the previous candle.

The RSI provides an indication that the market is oversold. This could mean that downward momentum is bottoming but traders should wait for the RSI to cross back over the 30 line for confirmation.

Stops can be placed below the new low and traders can enter at the open of the candle following the completion of the Bullish Harami pattern. Since the Bullish Harami appears at the start of a potential uptrend, traders can include multiple target levels to ride out a new extended uptrend. These targets can be placed at recent levels of support and resistance.

How Reliable is the Bullish Harami?

The validity of the Bullish Harami, like all other forex candlestick patterns, depends on the price action around it, indicators, where it appears in the trend, and key levels of support. Below are some of the advantages and limitations of this pattern.

Advantages

Limitations

Attractive entry levels as the pattern appears at the start of a potential uptrend

Should not be traded based on its formation alone

Can offer a more attractive risk to reward ratio when compared to the Bullish Engulfing pattern

Where the pattern occurs within the trend is crucial. Must appear at the bottom of a downtrend

Easy to identify for novice traders

Requires understanding of supporting technical analysis or indicators.

Popular: Stochastics and RSI

Further Reading on Candlestick Patterns

The Bullish Harami is just one of many candlestick patterns commonly used to trade the financial markets.

Candlesticks form an important role in the analysis of forex trading. Learn How to Read a Candlestick Chart.

If you are just starting out on your forex trading journey it is essential to understand the basics of forex trading in our New to Forex guide.

Source link Forex Trading Benefits

0 notes

Text

How to Trade with the Bearish Harami

New Post has been published on https://forexsuccesstips.net/how-to-trade-with-the-bearish-harami/

How to Trade with the Bearish Harami

Trading the Bearish Harami: Main talking points

The Bearish Harami consists of two candlesticks and hints at a bearish reversal in the market. The Bearish Harami candlestick should not be traded in isolation but instead, should be considered along with other factors to achieve Bearish Harami confirmation.

This article will cover:

What is a Bearish Harami pattern

How to identify a Bearish Harami on a trading chart

How to trade the Bearish Harami candlestick pattern

What is a Bearish Harami pattern?

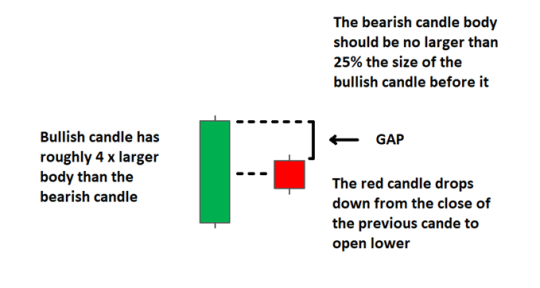

The Bearish Harami pattern is a reversal pattern appearing at the top of an uptrend. It consists of a bullish candle with a large body, followed by a bearish candle with a small body enclosed within the body of the prior candle. As a sign of changing momentum, the small bearish candle ‘gaps’ down to open near the mid-range of the previous candle.

The opposite of the Bearish Harami is the Bullish Harami and is found at the bottom of a downtrend.

How to identify a Bearish Harami on Trading Charts

Bearish Harami Checklist:

Identify existing uptrend.

Look for signals that momentum is slowing/reversing (stochastic oscillators, bearish moving average crossover, or subsequent bearish candle formations).

Ensure that the body of the small red candle measures no more that 25% of the previous bullish candle. Stocks will gap down, showing the red candle mid-way down the previous candle. The gap is likely not found in forex candlesticks as they will mostly open at the same level as the prior candle’s close or very close to it.

Observe that the entire bearish candle is enclosed within the length of the previous bullish candle’s body.

Look for confluence with the use of supporting indicators, key levels of resistance or other supporting evidence to support the trade.

It’s important to note, the Bearish Harami candlestick pattern will look different when observing it on a stock chart compared to the 24-hour forex market. Below we explore the formation of the pattern on both.

Formation of the Bearish Harami Pattern in the Forex market

The forex market operates on a 24/5 basis which means when one candle closes, another opens at virtually the same level of the previous candle’s closing price. This is often observed under normal market conditions but can change during periods of high volatility. The Bearish Harami pattern in forex will often look something like this:

The small red candle opens close to, or at the level that the prior bullish candle closed at. This is typically observed in the forex market.

Formation of the Bearish Harami Pattern in Stocks

Stocks on the other hand, have specified trading hours during the day and are known to gap down at the open for many reasons. Some of those might be:

Negative company news released after the close of trade

Country/sector data – viewed via an economic calendar – which is worse than expected.

Regulatory changes that will negatively affect future earnings

General (negative) market sentiment

Therefore, the more traditional Harami pattern appears, as seen below for FTSE 100 stock, Lloyds Banking Group PLC:

Notice how there are numerous areas on the chart where the market has gapped – showing wide open spaces between candles. This is often observed in the stock market.

How to Trade the Bearish Harami Candlestick Pattern

Traders can adopt the Bearish Harami 5-step checklist mentioned earlier in the article. Looking at the USD/SGD chart from earlier, we can observe the following:

There is a clear uptrend.

The RSI provides an indication that the market is overbought. This could mean that upward momentum is waning however, traders should always wait for the RSI to cross back over the 70 line for confirmation.

The bearish candle is no more than 25% the length of the previous candle.

The bearish candle opens and closes within the length of the previous candle.

This Bearish Harami appears at a new high so traders should be aware that the market has turned lower from even lower highs previously. Subsequent price action also helps support the new downward momentum indicated by the Bearish Harami.

Stops can be placed above the new high and traders can enter at the open of the candle following the completion of the Bearish Harami pattern. Since the Bearish Harami appears at the start of a potential downtrend, traders can include multiple target levels to ride out a new extended downtrend.

How reliable is the Bearish Harami?

The validity of the Bearish Harami, like all other candlestick patterns, depends on the price action around it, indicators, where it appears in the trend, and key levels of resistance. Below are some of the advantages and limitations of this pattern.

Advantages

Limitations

Attractive entry levels as the pattern appears at the start of a potential downtrend

Should not be traded based on its formation alone

Can offer a more attractive risk to reward ratio when compared to the Bearish Engulfing pattern

Where the pattern occurs within the trend is crucial. Must appear at the top of an uptrend

Easy to identify for novice traders

Requires understanding of supporting technical analysis or indicators.

Popular: Stochastics and RSI

Further Reading on Candlestick patterns

Candlesticks form an important role in the analysis of forex trading. Learn How to Read a Candlestick Chart.

If you are just starting out on your forex trading journey it is essential to understand the basics of forex trading in our New to Forex guide.

Multiple candlesticks combine to form recognizable patterns. Test your knowledge with our forex trading patterns quiz!

Source link Forex Trading Education

0 notes